Digital Transformation potential in AgTech

Digital technologies hold tremendous potential to transform the Agriculture sector by improving the efficiency of farming methods, resulting in better utilisation of resources and energy. The core driver behind rising adoption of digital technologies in this sector is the need for sustainable and consistent production, helping the industry overcome the challenge of high food demand with limited resources (especially water and land), climate change and increasing cost of labour and raw materials.

Digital transformation in Agriculture incorporates the use of granular monitoring techniques (with sensors), drones, agricultural vehicles and robots to optimise the use of resources (seed, fertilizers, water) and quickly react to threats (weeds, pests, fungi). Most of the DX solutions discussed in this document benefit businesses by improving yields, enhancing the quality of crops, improving farm productivity and reducing production costs (including labour costs). Furthermore, they significantly contribute towards sustainability goals by reducing water usage, food wastage, preventing groundwater contamination, and reducing the amount of fuel used in trips taken by farmers for monitoring fields.

Nine key domains of change in AgTech

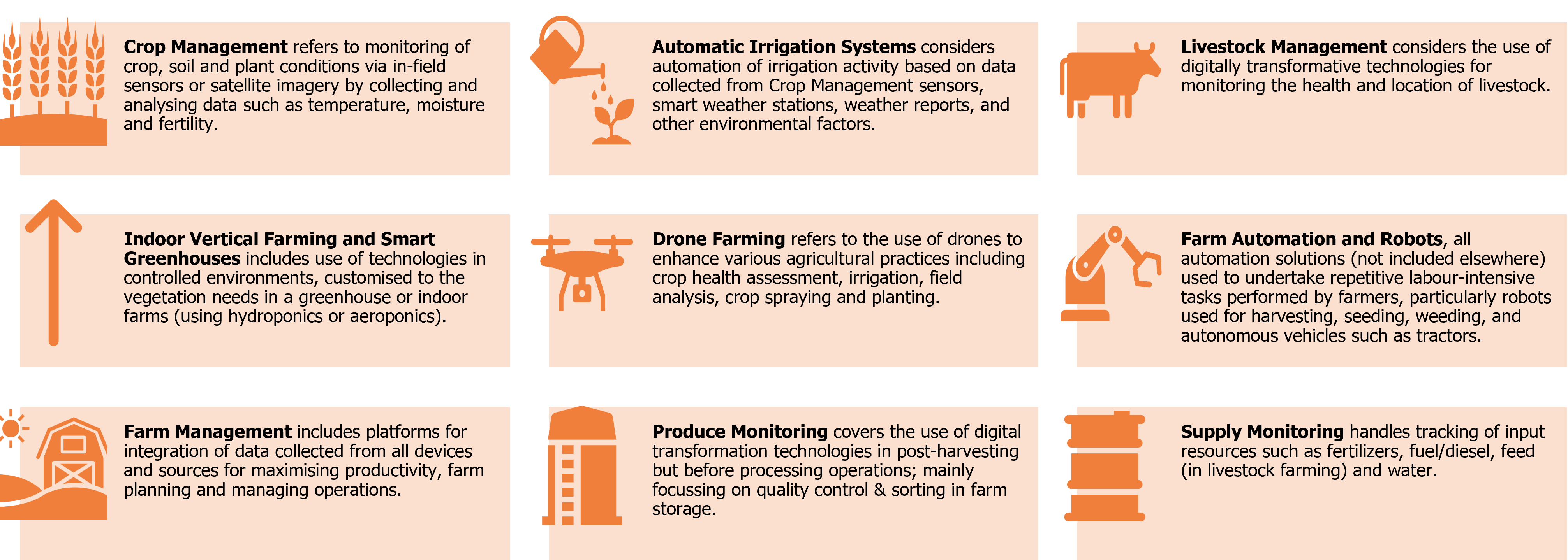

Overall, we have identified nine key domains of change in the Agriculture sector that are enabled by digital transformation, as illustrated below.

These domains of change are discussed in more detail in our report Digital Transformation in the Agriculture Sector:

The domains of change discussed in the report comprise:

Crop Management refers to monitoring of crop, soil and plant conditions via in-field sensors or satellite imagery by collecting and analysing data such as temperature, moisture and fertility.

Automatic Irrigation Systems considers automation of irrigation activity based on data collected from Crop Management sensors, smart weather stations, weather reports, and other environmental factors.

Livestock Management considers the use of digitally transformative technologies for monitoring the health and location of livestock.

Indoor Vertical Farming and Smart Greenhouses includes use of technologies in controlled environments, customised to the vegetation needs in a greenhouse or indoor farms (using hydroponics or aeroponics).

Drone Farming refers to the use of drones to enhance various agricultural practices including crop health assessment, irrigation, field analysis, crop spraying and planting.

Farm Automation and Robots includes all automation solutions (not included elsewhere) used to undertake repetitive labour-intensive tasks performed by farmers, particularly robots used for harvesting, seeding, weeding, and autonomous vehicles such as tractors.

Farm Management includes platforms for integration of data collected from all devices and sources for maximising productivity, farm planning and managing operations.

Produce Monitoring covers the use of digital transformation technologies in post-harvesting but before processing operations; mainly focussing on quality control & sorting in farm storage.

Supply Monitoring encompasses tracking of input resources such as fertilizers, fuel/diesel, feed (in livestock farming) and water.

Collectively, the activities listed above will bring significant changes to the AgTech sector.

IoT and AgTech

IoT is one of the key technology groups impacting the Agriculture sector and further detail and analysis of key IoT applications for the Agriculture sector can be found in Transforma Insight’s Forecast Insight Reports. Some of these applications are directly relevant to the sector, whilst others are only indirectly related.

Directly related IoT applications and Forecast Insight Reports include:

-

Worker Safety

– This report focuses on lone worker safety solutions across various industry verticals, particularly those involving dangerous environments such as logging and mining. It also covers personal monitoring and support solutions, including bodycams, for fire service, police, and emergency medical service personnel.

-

Asset Monitoring

– This application group encompasses a variety of assets that are suitable for remote monitoring. This includes the monitoring of livestock and associated applications such as automated feeders. It also covers the monitoring of fitness equipment located in gyms and other shared contexts. Tracking and monitoring of equipment in ambulances is also incorporated as part of the healthcare vertical.

Furthermore, this Application Group includes connected video gaming machines, gambling machines and other devices such as pachinko machines. Monitoring the condition, availability, and use of assets important to public health such as life rings and defibrillators is also present in this application group, including access to potentially dangerous infrastructure such as substations.

-

Environment Monitoring

– The use of sensors to monitor for a diverse range of pollutants or other environmental factors. This might include CO2, flood water, radioactivity, seismic shock, or pollutants from industrial processes, as well as seismic, tsunami, hurricane, and flood monitoring.

-

Crop & Aquaculture Management

– This Application Group covers the monitoring of crops and agricultural land for soil condition and local environmental data. This Application Group also includes monitoring in an aquacultural context.

-

Unmanned Non-Road Vehicles

– The Unmanned Non-Road Vehicles Application Group represents autonomous wheeled and tracked vehicles used for transporting materials, performing specific tasks or other similar activity in verticals such as agriculture, construction, mining, manufacturing, baggage handling, warehousing, space exploration or emergency response. The types of vehicles covered in this Application Group include forklifts, bomb-disposal vehicles, portside automated vehicles, straddle carriers and other specialised vehicles.

-

Remote Process Control

– This Application Group refers to the remote monitoring of equipment to manage devices or machines in the context of a wider business process and to integrate machine data with a particular focus on industrial and agricultural processes.

Includes factory automation, airport automation systems and baggage handling, and automated port systems. Excludes warehousing. Also part of this Application Group is crop irrigation, including connections to, and control systems for, systems that are deployed in the open air and also in closed environments such as greenhouses.

-

Unmanned Aquatic & Aerial Vehicles (Drones)

– This Application Group consists of two main categories: Unmanned Aerial Vehicles, which include fixed-wing and rotor wing unmanned aerial vehicles (UAVs) for military, government, consumer, or commercial use, and Unmanned Aquatic Vehicles that comprises small underwater and surface vehicles, typically manufactured for military use or exploration.

Indirectly related IoT applications and Forecast Insight Reports include:

-

Trigger Devices

– Simple devices that are triggered and indicate the need for action, such as something which is full and needs to be emptied or something which is empty and needs to be filled. Examples include buttons for room service, table service, replenishment of communal supplies, commercial mail delivery and collection boxes, and customer voting buttons.

-

Global IoT Forecast Report, 2024-2034

-

Global AIoT Forecast, 2023-2033

-

Road Fleet Management

– Road Fleet Management covers in-vehicle transportation logistics solutions including job allocation, vehicle tracking, vehicle and driver monitoring, maintenance planning, safety compliance, fuel management, and incident management. It can be delivered as a service via a dedicated aftermarket device or through factory-fit connectivity (accessed via the vehicle head unit). The forecast takes both heavy- and light-duty vehicles into consideration. It includes devices deployed in cars, vans, trucks, and buses, along with heavy vehicles such as tractors, combine harvesters, pile drivers, tunnelling machines, cranes, and other off-road equipment.

-

Global IoT Forecast Report, 2023-2033

-

Real World 'Visualisation'

– Includes the use of Human Machine Interface (HMI), Augmented Reality (AR), and Virtual Reality (VR) devices such as smart connected glasses, such as Microsoft’s Hololens, or Google Glass, used in either a consumer or enterprise context; standard and ruggedised tablets that can be used to access information about machinery and processes (and more); and large scale video walls, either in the context of control rooms, or to support immersive experiences.

Other content and related analysis

Besides the detailed sector-focussed content described above, Transforma Insights offers an extensive range of thematic- and vendor-focussed research that will prove invaluable to any end-user seeking to leverage new and emerging digitally transformative technologies.

Of particular note are our Vendor Insight and CSP Peer Benchmarking reports, which provide detailed profiles of leading vendors who might be able to support a range of end-user digital transformation projects.

Our Key Topic Insight reports focus on the qualitative aspects of Digital Transformation, including investigation of interesting or noteworthy topics.

Detailed analysis of regulations that might apply to digitally transformative projects around the world can be found in our Regulatory Database. Meanwhile, our Case Study Database contains more than 1,000 case studies of technology implementations. Each case study contains detailed information on the specifics of the deployment. Used in aggregate it can provide unrivalled guidance on project prioritisation, best practice and vendor selection.