Digital Transformation potential in Future Field Force

Field force service operations are a key aspect of many industries. The success of these operations often depends on managing customer relationships, ensuring the right people are at the right place at the right time and with the right tools, and enhancing KPIs such as the first-time resolution rate, mean repair rate, precise scheduling, resolution time, and asset uptime or availability.

However, achieving these goals is becoming difficult as the field force sector faces challenges with increasing product complexity combined with a shortage of skilled workers. Complex machinery often serves specific customer requirements and can vary significantly in terms of build and configuration, which makes it difficult for field personnel to acquire technical mastery over the entire installed base. Additionally, in some industries, machinery is often installed in remote or inaccessible locations and frequent visits by service technicians can be inefficient and expensive.

Companies can better manage these challenges by incorporating digital technologies such as IoT, artificial intelligence (AI), augmented reality, virtual reality, and others into their business operations. For example, with IoT and AI, dispatchers can track field workers efficiently and optimise work schedules. Digital solutions can increase the first-time resolution rate , increase the productivity of mobile workers, and decrease truck rolls (and associated carbon emissions), including by addressing some problems remotely.

Five key domains of change in Future Field Force

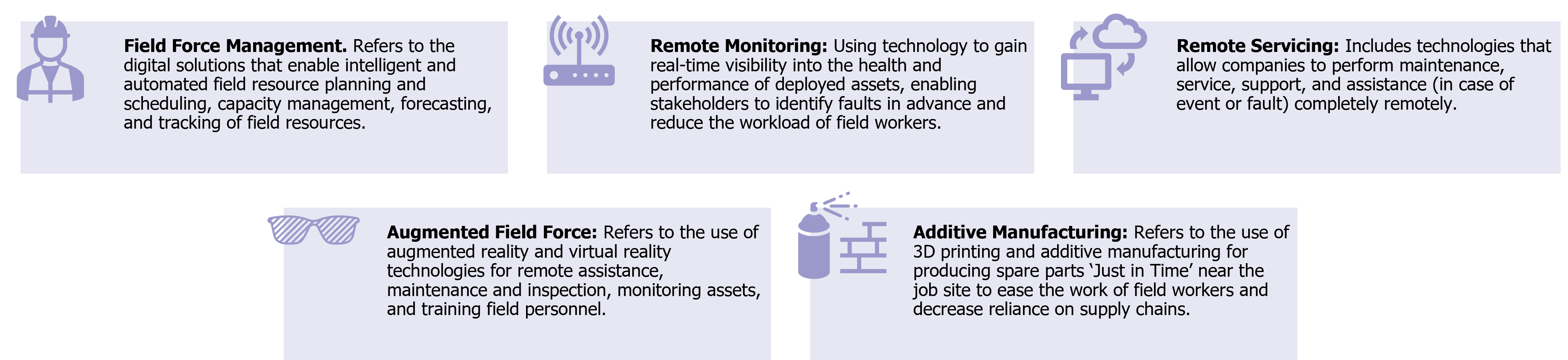

Overall, we have identified five key domains of change in the Future Field Force sector that are enabled by digital transformation, as illustrated below.

These domains of change are discussed in more detail in our report Digital Transformation in Future Field Force:

The domains of change discussed in the report comprise:

Field Force Management, which refers to the digital solutions that enable intelligent and automated field resource planning and scheduling, capacity management, forecasting, and tracking of field resources.

Remote Monitoring, using technology to gain real-time visibility into the health and performance of deployed assets, enabling stakeholders to identify faults in advance and reduce the workload of field workers.

Remote Servicing, includes technologies that allow companies to perform maintenance, service, support, and assistance (in case of event or fault) completely remotely.

Augmented Field Force, refers to the use of augmented reality and virtual reality technologies for remote assistance, maintenance and inspection, monitoring assets, and training field personnel.

Additive Manufacturing, refers to the use of 3D printing and additive manufacturing for producing spare parts ‘Just in Time’ near the job site to ease the work of field workers and decrease reliance on supply chains.

Collectively, the activities listed above will bring significant changes to the Future Field Force sector.

IoT and the Future Field Force

IoT is one of the key technology groups impacting the Future Field Force sector and further detail and analysis of key IoT applications for the Future Field Force sector can be found in Transforma Insight’s Forecast Insight Reports. Some of these applications are directly relevant to the sector, whilst others are only indirectly related.

Directly related IoT applications and Forecast Insight Reports include:

-

Security Tracking

– Includes a range of security-related applications for security guards, prison guards, and for offender tagging. The use of ‘smart soldier’ equipment by defence personnel in a military context is also included.

-

Remote Diagnostics & Maintenance

– Remote monitoring of equipment to spot faults and predict maintenance requirements. This monitoring is conducted to detect, identify, and prevent faults and includes service-based business models to provide ongoing monitoring and predictive maintenance of equipment. This is particularly focused on factory machinery, healthcare devices, and vertical transportation (elevators and escalators).

-

Worker Safety

– This report focuses on lone worker safety solutions across various industry verticals, particularly those involving dangerous environments such as logging and mining. It also covers personal monitoring and support solutions, including bodycams, for fire service, police, and emergency medical service personnel.

-

Vending Machines

– There are two main categories covered in this Application Group: Goods Vending Machines and Transport Ticket Machines. Goods Vending Machines dispense hot and cold drinks, prepared and semi-prepared food, cigarettes, electronics goods, and sundry other items. Transport Ticket Machines are used at bus, ferry, tram, or train stations for the purchase of tickets. Customers can make use of digital payment methods or cash.

-

Road Fleet Management

– Road Fleet Management covers in-vehicle transportation logistics solutions including job allocation, vehicle tracking, vehicle and driver monitoring, maintenance planning, safety compliance, fuel management, and incident management. It can be delivered as a service via a dedicated aftermarket device or through factory-fit connectivity (accessed via the vehicle head unit). The forecast takes both heavy- and light-duty vehicles into consideration. It includes devices deployed in cars, vans, trucks, and buses, along with heavy vehicles such as tractors, combine harvesters, pile drivers, tunnelling machines, cranes, and other off-road equipment.

-

Remote Process Control

– This Application Group refers to the remote monitoring of equipment to manage devices or machines in the context of a wider business process and to integrate machine data with a particular focus on industrial and agricultural processes.

Includes factory automation, airport automation systems and baggage handling, and automated port systems. Excludes warehousing. Also part of this Application Group is crop irrigation, including connections to, and control systems for, systems that are deployed in the open air and also in closed environments such as greenhouses.

-

Portable Information Terminals

– This Application Group contains the use of portable information terminals for staff in a range of vertical contexts, including retail and hotels. Many of these terminals will be tablets. However, to be counted as part of this forecast the tablet must be a single-purpose device used in an enterprise context.

-

Dash Cams

– Dash cams are video camera systems mounted on the dashboard or windscreen of a vehicle to provide a view of the road, traffic, driver, or vehicle interior. These can be forward facing (road facing) or dual facing (road and driver facing). Most connected dash cams are used to live stream videos, but some can cache video footage for on-demand viewing as well. They are also used to help combat vehicle theft and fraudulent insurance claims, safeguard drivers, and ensure road safety.

Indirectly related IoT applications and Forecast Insight Reports include:

-

CCTV

– Connected video cameras used for public safety and surveillance, mostly installed and monitored by government bodies for the monitoring of streets and public places.

-

Inventory Management & Monitoring

– This Application Group pertains to the remote monitoring of volumes and inventory, including consumables, warehouse stock, retail stock, and refuse levels. It encompasses stock level and condition monitoring, such as specialist inventory systems, baggage handling systems, soap dispensers, toilet doors, pest control, and various other use cases. It also covers all types of electronic shelf labels. Additionally, this group includes warehouse management systems, which involve picking machinery and warehouse robots (unless counted in other autonomous vehicles or robotics categories as is the case for cobots and automated forklifts).

-

Autonomous Road Freight Vehicles

– The vehicles included in this Application Group are used for transporting goods on the road in a commercial setting. To be counted as part of this Application Group vehicles must be capable of operating at Level 3 of the SAE levels of autonomy. This level of automation requires the vehicle to monitor the environment and requires “the driving mode-specific performance by an automated driving system of all aspects of the dynamic driving task.”

-

Waste Management

– Waste Management covers the monitoring and handling of waste to reduce its harmful effects on humans, the environment, and other planetary resources. The Waste Management Application Group includes the use of connected refuse bins (such as those provided by Bigbelly), aftermarket monitoring devices for wheelie bins, and other refuse collection systems.

-

Trigger Devices

– Simple devices that are triggered and indicate the need for action, such as something which is full and needs to be emptied or something which is empty and needs to be filled. Examples include buttons for room service, table service, replenishment of communal supplies, commercial mail delivery and collection boxes, and customer voting buttons.

-

In-Vehicle Navigation

– This Application Group includes navigation applications – either hosted on vehicle head units or dedicated aftermarket devices – that are used to provide directions and routes to drivers. Built-in devices that rely on the vehicle head unit for a connection do not register as a discrete connection in our forecast.

-

Real Time Location Systems

– The Real Time Location Systems Application Group covers the use of trackers attached to pieces of equipment or employees for locating them, typically with great accuracy, in real-time. These solutions are normally used within defined areas (such as hospitals, building sites, and factories) with dedicated infrastructure to support them.

-

Asset Monitoring

– This application group encompasses a variety of assets that are suitable for remote monitoring. This includes the monitoring of livestock and associated applications such as automated feeders. It also covers the monitoring of fitness equipment located in gyms and other shared contexts. Tracking and monitoring of equipment in ambulances is also incorporated as part of the healthcare vertical.

Furthermore, this Application Group includes connected video gaming machines, gambling machines and other devices such as pachinko machines. Monitoring the condition, availability, and use of assets important to public health such as life rings and defibrillators is also present in this application group, including access to potentially dangerous infrastructure such as substations.

-

Delivery Robots

– This Application Group covers small (i.e. not capable of intercity travel or carrying passengers) fully autonomous vehicles that travel on road or pavement to deliver food, beverages, retail shopping, documents and other goods.

-

Global IoT Forecast Report, 2024-2034

-

Track & Trace

– The use of trackers to monitor the location (and potentially condition) of a particular item, which could include tools, equipment, manhole covers, packages, pallets, goods in transit or almost anything else. This can be for supply chain efficiency, theft detection and asset location monitoring. This forecast category includes all other location tracking not elsewhere covered.

-

Infrastructure Monitoring

– Includes the monitoring of road and rail infrastructure, dams (including hydroelectric and tailing), levees, reservoirs, weirs, and pipelines, for the purpose of checking for structural issues, breakages, theft, or other faults. Monitoring devices installed during construction projects counts within the Construction vertical but subsequently to the appropriate specific vertical (typically government) at point of handover.

-

Global AIoT Forecast, 2023-2033

-

Grid Operations

– The Grid Operations Application Group includes the management and monitoring of infrastructure related to the distribution, and consumption of electricity, gas, water, and sewage for maintenance, diagnostics, fault discovery, and loss reduction purposes. In the context of electricity distribution, this particularly relates to the management of the relationship between various elements (i.e. as a Virtual Power Plant).

-

Unmanned Non-Road Vehicles

– The Unmanned Non-Road Vehicles Application Group represents autonomous wheeled and tracked vehicles used for transporting materials, performing specific tasks or other similar activity in verticals such as agriculture, construction, mining, manufacturing, baggage handling, warehousing, space exploration or emergency response. The types of vehicles covered in this Application Group include forklifts, bomb-disposal vehicles, portside automated vehicles, straddle carriers and other specialised vehicles.

-

Unmanned Aquatic & Aerial Vehicles (Drones)

– This Application Group consists of two main categories: Unmanned Aerial Vehicles, which include fixed-wing and rotor wing unmanned aerial vehicles (UAVs) for military, government, consumer, or commercial use, and Unmanned Aquatic Vehicles that comprises small underwater and surface vehicles, typically manufactured for military use or exploration.

-

Global IoT Forecast Report, 2023-2033

-

Roadside Assistance

– The Roadside Assistance Application Group focuses on the notification of recovery services in the event of a vehicle breakdown or any other emergency. Recovery services include vehicle towing, winching, fuel deliveries, and battery- and tyre-related services. Vehicle diagnostics and location tracking may also be included to improve its efficiency. This application includes aftermarket devices in addition to applications hosted on the vehicle head unit.

-

Personal Assistance Robots

– This Application Group includes fully autonomous AI robots which undertake a diverse set of use cases including security monitoring, maintenance, human interaction, companionship, and other tasks. This includes robotic pets, cleaning robots (for instance, Roomba), lawn mowers, exoskeletons, cooking robots, room and table delivery, and concierge services.

-

Real World 'Visualisation'

– Includes the use of Human Machine Interface (HMI), Augmented Reality (AR), and Virtual Reality (VR) devices such as smart connected glasses, such as Microsoft’s Hololens, or Google Glass, used in either a consumer or enterprise context; standard and ruggedised tablets that can be used to access information about machinery and processes (and more); and large scale video walls, either in the context of control rooms, or to support immersive experiences.

Other content and related analysis

Besides the detailed sector-focussed content described above, Transforma Insights offers an extensive range of thematic- and vendor-focussed research that will prove invaluable to any end-user seeking to leverage new and emerging digitally transformative technologies.

Of particular note are our Vendor Insight and CSP Peer Benchmarking reports, which provide detailed profiles of leading vendors who might be able to support a range of end-user digital transformation projects.

Our Key Topic Insight reports focus on the qualitative aspects of Digital Transformation, including investigation of interesting or noteworthy topics.

Detailed analysis of regulations that might apply to digitally transformative projects around the world can be found in our Regulatory Database. Meanwhile, our Case Study Database contains more than 1,000 case studies of technology implementations. Each case study contains detailed information on the specifics of the deployment. Used in aggregate it can provide unrivalled guidance on project prioritisation, best practice and vendor selection.